It feels like this year is just flying by because here I am again with another goals update! Unfortunately, June wasn’t that great of a month for me goals wise. I got set back a little financially with the trips and my fitness goals were pretty much shot to hell, but just because you trip or fall doesn’t mean you shouldn’t get back up. I’m really hoping July will be a killer month, but we’ll see! And if you haven’t already, click here to read my original goals post!

Career Goals

I finally got my 2nd certification, the PMI-Agile Certified Practitioner (PMI-ACP) renewed! So we can check that off the list! I signed up for the PMP course to get the PDUs I needed and then realized I had to submit a completed project and take a practice test and there was no way I was going to make it in time for my June 18th expiration. Thankfully, a friend of mine told me you can get credit for listening to podcasts! So I had to listen to 30 hours worth of podcasts to get the 30 PDUs that I needed. (Talk about lifesaver!) I do plan on completing that PMP course so hopefully I’ll be ready to take the actual PMP exam by the end of the year. I’m debating on pushing the PMP goal to early next year if my company has the budget to pay for it, but we will see. Taking the online course reminded me of why I never wanted to pursue higher education, but I digress…

Fitness Goals

I’m still really struggling with my fitness goals. I’m still going to the gym pretty consistently, but the trips in June threw me off and I’ve honestly been eating like crap. I’m taking this weekend to reset, get back on my meal prep, and get back on that regular schedule. It’s so hard to get back on the horse after you’ve fallen, but seriously, I need to just keep going.

Financial Goals

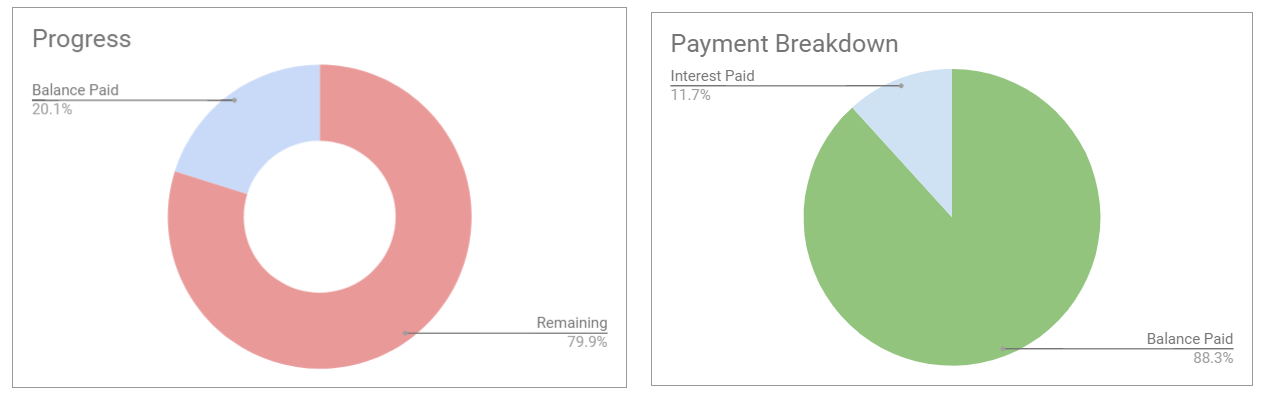

Like I said earlier, I hit a set back financially with the trip to Vegas and California. I’m at 20.1% progress in debt payoff which is pretty much the same as what it was last month. I had to make a decision on whether to use the extra $1000 I put on my debt for my trips or to keep chipping away at the debt. If I kept putting it on my loan, I’d be on track to pay off my first loan at the end of August, but if not, it would be pushed to September/October. Not that big of a difference, but I’m really big on seeing the progress and I felt like it would kind of un-motivate me if I didn’t hit the target so I re-evaluated everything and ended up transferring what I spent on a card that has a temporary 0% APR and kept applying the extra to my loan. I hated seeing that balance go up but once I pay off that first loan, I think I’ll feel good about it and I’m not accruing any interest on that balance anyway. I’m actually really excited about paying it off and finally getting to the big fish – my car. I think once I pay off that first loan, I’ll be ready to reveal how much that was!

I did get my old 401ks consolidated like I said I was planning to last month, but that reminds me I still need to do that with my HSAs. I’m happy to report that my overall net worth is positive! I think it has been for a while and I was just obsessing about the debt numbers but I suppose I should celebrate the little wins.

Blog Goals

I don’t know why progress in this area is just slow and steady. I did 3 posts in June, which is the same that I did in May. I decided that I’m putting myself on a posting schedule (I know I should’ve done this a long time ago) and post at least once a week. I was going to pick Wednesdays as my post day but then realized I always end up posting on a Thursday (like today) so Thursday weekly posts it is! I’m going to try to do more than once a week, but at the bare minimum, once a week.

Until next month!

2 replies on “Goals Progress – July 2018”

[…] Renew PMI-ACP Certificate (July 2018) […]

[…] that I’ve been laziest in. The good news is, I saw some progress in this area for July. Since my last goals post, I’ve published 6 more posts!! Wayy more than I have in any other month. I’ve been […]