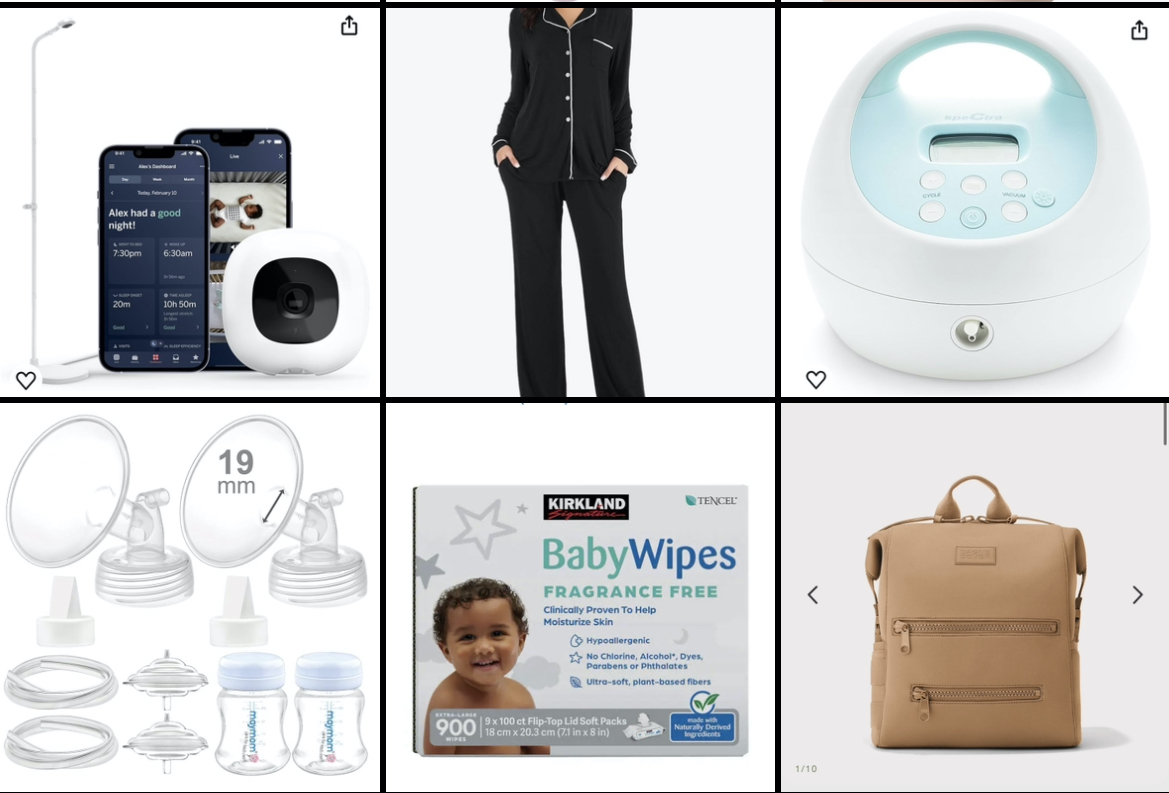

I did a separate post on the baby gear worth checking out at the Nordstrom Anniversary sale and to be honest the last few years has been kind of lackluster to me but if you’re shopping for things that have been on your list or things that you repurchase, some things may be worth checking […]